Loading...

The Polish recommerce market is experiencing a sales boom. This is illustrated by the data in the report ‘E-commerce in Poland 2024’. Poles are increasingly willing to buy and sell second-hand items, thus driving the development of the C2C sector. Second-hand trade, once regarded as a low-cost shopping alternative, is now taking on a new role, involving a profitable buy-sell transaction, in the spirit of ‘zero waste’.

In the following article, I analyse the most important data relevant to the prevailing new recommerce trend.

Until recently, second-hand sales were associated with local ‘street corner’ shops. Second-hand shops offered, among other things, clothes, books or antiques. Over time, with the development of e-commerce, the shops moved online and made their mark there. This in turn gave impetus to the development of online second-hand sales by various industries, on a large scale.

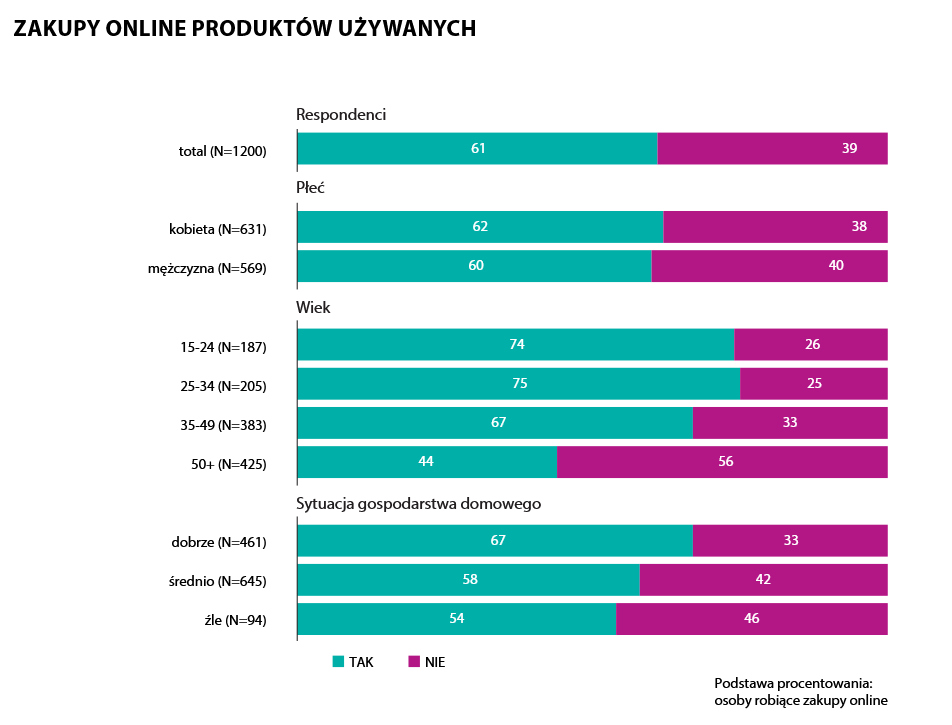

As the report shows, as many as 61% of respondents have ever bought a second-hand product online [E-commerce in Poland 2024, p. 4]. This only highlights how Poles’ preferences for convenience and time spent on purchases are changing.

The definite buying group in the recommerce market is the 15-24 and 25-34 age range. As we can see in the graph below, the trend is consistently declining in the older generations.

Interestingly, respondents’ answers showed that the higher the financial status, the higher the percentage of recommerce purchases. Interpreting this data, it can be inferred that price is not a determining factor for the development of second-hand trade, and this in turn gives space for non-financial factors to be taken into account.

In relation to these non-financial factors, one cannot fail to mention the growing popularity of a life-style approach that respects the natural environment. There is a growing clamour for scandals linked to the aftermath of the actions of, for example, clothing manufacturers. Demand driving supply will always be reflected in mass production, which will leave its mark on natural resources in the form of excessive consumption.

Consumers, recognising the problems associated with the abuse of the ecosystem, are choosing to buy second-hand products, thus promoting the trend towards a zero waste lifestyle. In correlation with environmental awareness, there is also the age of the consumer, where Generation Z now has an unquestionable say in prudent shopping. Young people, whose adolescence coincided with the massive growth of electronics in Poland, are more likely than their parents to pay attention to the harmful actions of manufacturers, thus choosing to buy from proven brands. At the same time, they value second-hand shopping, deriving satisfaction from giving a second life to products. They regard recommerce shopping itself as a form of spending well, as well as a frugal approach to their spending.

Patrycja Sass-Staniszewska, CEO of Chamber of Electronic Commerce, pointed to data on Generation Z in relation to the recommerce industry. She emphasised that 54% of representatives of this generation buy second-hand products, while 55% declare active sales, which is double the figures for older consumers [Gen Z Mindset, e-Izba, 2024].

As a representative of generation Z, I will not refer directly to the data, but from autopsy and my own observations I can subscribe to this optimistic statement, confirming the trend of second-hand product purchases in my generation.

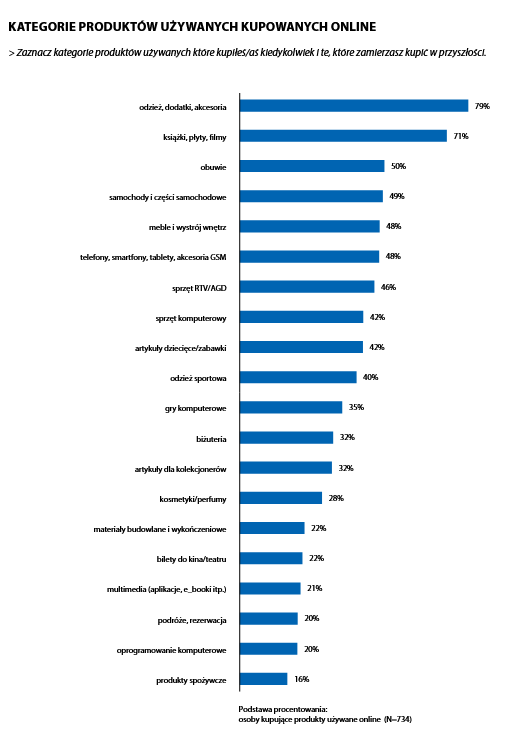

As presented in the aforementioned report, the leader among the categories of products used and bought online is “clothing, accessories and accessories”. In 2024, 8 out of 10 respondents bought second-hand clothing [E-commerce in Poland 2024, p.261]. In second place, losing by 8 percentage points, was the category ‘books, records and films’. This was followed by the following categories: “footwear”, “cars and car parts”, “furniture and interior design”, or product categories from the electronics industry. On the basis of these results, it may be concluded that some second-hand products, just like new products, the consumer prefers to see first and only then decide to buy. This is most often the case with ranges that cost money but are intended to last for years. In addition to this, we also have products from categories such as “jewellery”, “cosmetics and perfumes” or “sportswear”, which, due to their nature, are also not yet gathering as much interest in online second-hand sales.

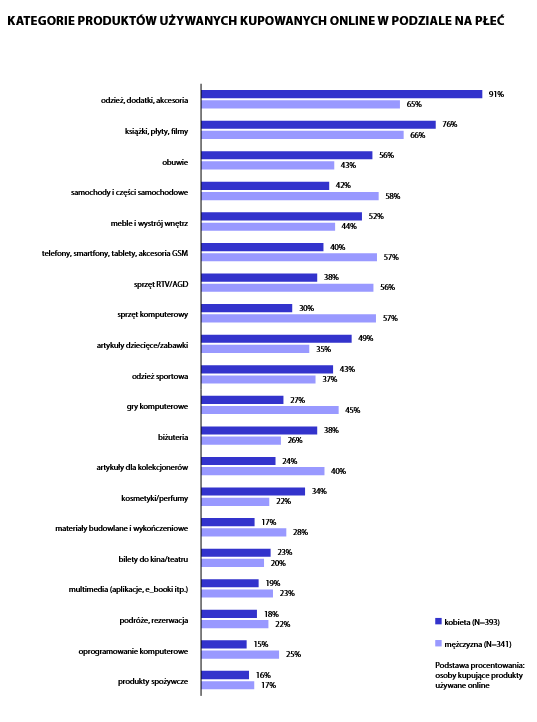

For the product categories listed, the report shows the share of buyers by gender.

Women are far more likely to buy second-hand clothing, accessories or accessories. They are more likely to complete a transaction in the second-hand market for cosmetics, perfumes or jewellery.

In contrast, the opposite is true in the automotive and electronics sectors, where consumers tend to be men. Their attention is also drawn to second-hand collector’s items, as well as software and computer games.

Some categories show no significant differences, e.g. ‘cinema theatre tickets’, ‘travel, booking’, ‘sportswear’ or ‘food products’.

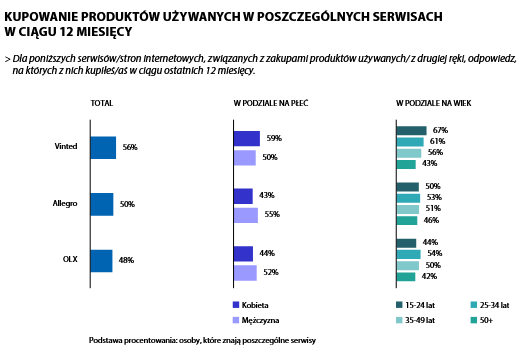

In 2024, the leader for secondary sales has become the Vinted platform. This result should not come as a surprise if we consider the previously discussed data. The Lithuanian service, which brings together individuals selling and buying mainly second-hand clothes, fits in with the popular shopping direction of the recommerce market today.

Equally strong players are the Allegro and OLX platforms, which also engage well with today’s consumer.

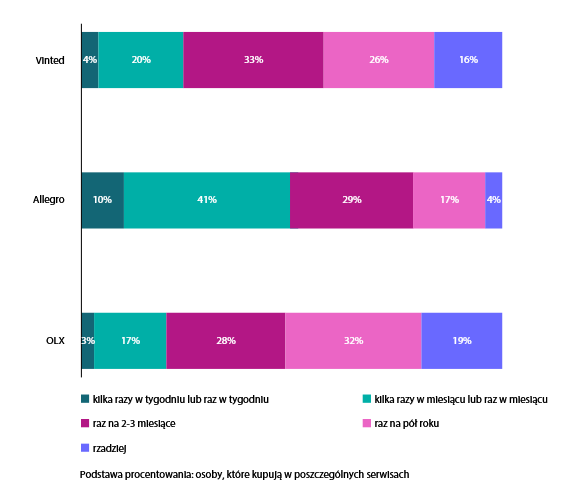

In terms of frequency of purchases of second-hand products, users most often – i.e. several times a week or once a week – opt for listings on Allegro. Also in the case of purchases made at least once a month, consumers are keen to use the Polish site.

For occasional transactions, Vinted and OLX are gaining an increasing share, which may indicate that consumers are selecting non-primary products on these platforms for which they are willing to pay more.

Is the recommerce industry a revolution in the approach to online shopping in Poland today? Definitely yes. The statistics from the report ‘Ecommerce in Poland 2024’ speak for themselves. The value of products used in e-commerce is growing, and this is being driven by society’s growing awareness of responsible shopping. The fact that a young group of consumers is taking a leading role in second-hand sales fosters optimism for the future. In turn, the increasing use of the Internet and the development of e-services means that we can see when a noticeable change will also take place among the older generations.

Copyrights © Media4U Sp. z o.o. All Rights Reserved.

Privacy Policy